Further to our initiation report published in July 2022 and a visit to site, we include an update on developments at Falun as well a potential development scenario for the Sala project with the following key assumptions: ϕ an increased mineral resource to 22 Mt (from the 9.7 Mt maiden resource) with same grades: 3.20% Zn, 47.3 g/t Ag and 0.50% Pb. κ a mining inventory of 13.9 Mt (corresponding to a mineral resource to mining inventory conversion of 63% or about 3 times the high grade portion of the maiden mineral resource) with the grades of the high grade portion: 4.50% Zn, 58.4 g/t Ag and 0.50% Pb. λ a throughput of 1 Mtpa. μ operating costs derived from the Björkdal gold mine (similar reserve and throughput) located in Sweden and operated by Mandalay Resources Corporation (TSX: MND). ν initial capital cost estimated at US$110m. We note the current strategic focus at Sala is to continue to build on this resource, but to also seek high grade silver repeats of the historic Sala formation. A high grade silver discovery, like a discovery at Falun, could have a major impact on the market valuation dynamics of AQI.

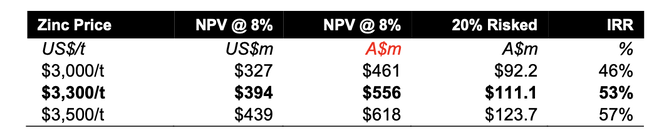

Sala Valuation: using different zinc price assumptions

Greater Falun Project: the confirmed acquisition of the historical Falun mine and the initial drill hole at Skyttgruvan adds the potential for a second major project for AQI to replicate what it is currently achieving at Sala: delineating substantial new mineral resources to support a restart of the mining operations. In this case, seeking another Falun copper-gold style ore body within the target mineralisation. We note the Falun mine was one of the great mines of Europe historically producing 28mt @ 4% Cu, 4g/t Au, 5% Zn, 2% Pb and 35g/t Ag before it was closed in 1992. The lack of modern exploration at either Falun or Sala creates significant opportunity for the company.

Copper-Gold Exposure: furthermore the Falun project with identified copper-gold mineralised targets brings higher value metals into the polymetallic mix.

Quality Drill Targets & Proof of Concept: both projects present a large number of drill targets identified and supported for some of them by previous drilling. Furthermore, beyond the near-mine targets, the drilling results from the first drillhole at Skyttgruvan, located only 3.5km from Falun, validates to geological model which should see in time the discovery of multiple analogue deposits along the target horizon.

Sweden Context: Over a few centuries, Sweden has developed a significant polymetallic base metals (and precious metals) mining industry including recycling and smelting capacity. The maiden Sala mineral resource represents already the largest active undeveloped Zn-Ag-Pb mineral resource in Sweden. Sweden accounts for 36% of Europe’s zinc production and is the second largest producer next to Russia. Considering the sanctions against Russia, more pressure is being put onto Sweden to supply the region with Green Zinc. Sweden is leading the Green Transition in Europe with its 98% fossil fuel free electricity supply. The Swedish government including at the local level is supportive of both projects and is very keen to see Sala and Falun get up and operating. Sweden, which has kept economic flexibility with its own currency, Swedish Krona (SEK) also benefits from low operating costs e.g. US50¢/lb Zn at Garpenberg (50km away) while extracting ores between 450m and 1,400m depths.

Management: the AQI team has a highly successful track record including Auteco Minerals (AUT), Bellevue Gold (BGL) and Centaurus Metals (CTM).

Metals Outlook: the outlook for copper, zinc and silver prices remains positive with the copper market staying tight, market deficits expected for zinc and the silver ETP market likely to grow substantially higher over the next few years.

News Flow and Funding: upcoming news flow includes drilling results, metallurgical testwork, scoping study, update of the mineral resource estimate and environmental permitting milestones.

AQI Valuation: our SOTP valuation includes a risked-NPV for Sala and a “back of the envelope” estimate for the potential mineralisation at Greater Falun to derive a price target of $0.26 per share (versus $0.22 previously). Beyond mineral resource definition, the development studies and project construction pave the way to higher valuation. To this end we note market valuations of Silver Mines (ASX: SVL, $197m market cap.) with an ore reserve amounting to 30 Mt at 69 g/t Ag, 0.44% Zn and 0.32% Pb at Bowdens in NSW and Adriatic Metals (ASX: ADT, $879m market cap.) with a 12 Mt at 149 g/t Ag, 4.1% Zn, 2.6 Pb, 0.5% Cu, 1.4 g/t Au, 25% BaSO4 and 0.2% Sb mineral resource at Vares currently in construction in Bosnia and Herzegovina.