Minbos Resources Ltd

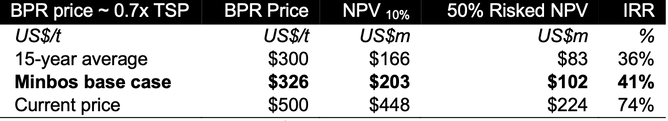

Definitive Feasibility Study (DFS): On 17th October 2022, MNB released the results of a DFS for the Cabinda phosphate project (85% MNB) in Angola. NPVs of US$203m (base case price) and US$399m (spot price) versus a low capex of US$49 million highlight the quality of the project economics.

Short Timeline to Production: First production is expected in Q4 2023, with fabrication of key major equipment from FEECO now completed.

Ideal Location: The World Bank recognises Angola as a potential agricultural powerhouse of Africa. Angola has 35 million hectares of arable land of which only 10% is currently cultivated and most of that by small holder farmers using little or no fertilizer.

Government Support: The Government of Angola with the support of development finance institutions such as the World Bank, the African Development Bank and the International Finance Corporation is targeting agriculture and specifically its 3 million smallholder farmers to diversify its economy and drive food security.

Intellectual Property: Minbos lodged an Australian provisional patent application for a new phosphate rock fertilizer blend, with the potential to produce a 100% organic phosphate fertilizer using less reactive phosphate rocks. The new phosphate rock fertilizer blend promotes the early release of phosphate nutrients from phosphate rock, potentially eliminating Monoammonium Phosphate (MAP) from the proposed Cabinda Phosphate granule formulation – delivering a 100% organic fertilizer blend.

New Cornerstone Investors: As part of the $25m placement in July 2022, Minbos and the syndicate of cornerstone investors (being Longmarch Principal Holding Limited, HongKong Jayson Holding Co., Ltd. and Hoston Investments (Australia) Pty Ltd.) have signed a Strategic Cooperation Agreement to develop Ferro Phosphate, Lithium Ferro Phosphate and Large- Scale Green Ammonia Projects.

LFP Batteries: To support the production of Lithium Iron Phosphate (LiFePO4) material and batteries by its new investors, Minbos commits to long term off-take of 100,000 tonnes per annum of high-grade phosphate rock at agreed market rates.

Capanda Green Ammonia Project: Thanks to uniquely low priced hydro- electricity (average of US1.1¢/kWh over 25 years), Minbos has the opportunity to develop an ammonia plant to produce ~300,000 tpa of green ammonium nitrate with an end product breakdown of ~50% fertilizer (CAN, calcium ammonium nitrate) and ~50% explosives grade ammonium nitrate, with flexibility on product mix. A technical study has just kicked off with results expected in six months.

Cabinda Valuation: based on various beneficiated phosphate rock prices:

Funding: paired with the July $25 million placement, Minbos signed a non- binding term sheet with Long March to provide US$25 million of debt on commercial terms including a 5-year maturity. The total funding required for the construction of the Cabinda project is estimated at US$40 million.

MNB Valuation: assuming an additional equity capital raising of A$30 million (200 million shares @ $0.15) in FY2024 to complement the debt, we derived a valuation of $258 million of $0.25 per share. Beyond the Cabinda rock phosphate project, which currently makes the key part of our valuation, Minbos project portfolio offers multiple ways to see its overall valuation increase quite significantly over the medium to long-term.