Tier-2 Pioneer Dome Mineral Resource: On 29th September 2020, ESS released a mineral resource estimate (MRE) of 11.2 Mt @ 1.21% Li2O. Both the resource tonnage and the contained lithia (Li2O) increased by 33%. More importantly 5.4 Mt or 51% of the contained lithia is classified as an Indicated mineral resource hence supporting the economic evaluation of the project through a scoping study. We assumed 7.5 Mt of mining inventory.

Great Location and Access: The project is located 10km from the Coolgardie-Esperance regional highway that connects the main mining centre of Kalgoorlie (150km to the north) and the large dry bulk & container seaport of Esperance (275km to the south). Unsealed access road connects the Project to the main highway.

Tier-1 Infrastructure and jurisdiction: The Pioneer Dome project is perfectly located to develop a mining operation. The surrounding land is flat-lying, lightly wooded land with no environmental or native title complexities. Both gas pipeline and water pipeline located alongside the main highway

Path to Production: thanks to a number of projects developed and now operating successfully, Australia has a developed significant processing expertise. In this context, the development of the Pioneer Dome will be facilitated for the benefit of Essential Metals.

Capital Expenditure: to allow for the flotation circuit and costs inflation, we assumed a development capital expenditure of $265 million, including $250 million pre-production. Note $85 million was estimated for the Finniss project. Operation Costs: those were derived from the Mt Cattlin restart study (1.6 Mt throughput) dated March 2021 after applying a 15% cost increase.

Lithium Outlook: after a few booms and bursts observed in the lithium sector over the last 15 years, the Electric Vehicle and Energy Storage revolution is now well underway. Lithium products pricing is at all time-high and all downstream off-takers are likely to struggle to secure raw materials for the foreseeable future.

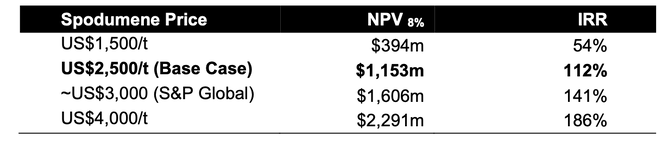

Pioneer Dome Valuation: using various spodumene prices,

News Flow and Funding: upcoming news flow includes drilling results, metallurgical testwork, update of the mineral resource estimate and scoping study results all expected before the end of 2022, and environmental permitting milestones. ESS is well funded to continue to develop and evaluate the Pionner Dome Lithium Project with $10.5m cash as at 30 June 2022 and potentially up to $3.1m from options conversion by the end of November 2022.

ESS Valuation: in addition, our sum of the parts valuation assumes an equity capital raising of $20 million @ $0.40 to complement the funding of the exploration and evaluation programs. Based on all those parameters, our price target for ESS stands at $357m or $1.12 per share. This price target is supported by the market values of Global Lithium Resources Ltd (ASX: GL1, mineral resource of 18.9 Mt @ 1.32% Li2O through two projects) and Red Dirt Metals Ltd (ASX: RDT, maiden mineral resource to be announced) with a current average market capitalisation of $328 million.

Investment Perspective: Mining is cyclical and timing is critical. After experiencing multiple successive boom and bust cycles, ESS appears very well positioned to benefit from a stronger and longer lithium market cycle as the EV market growth is accelerating on a global scale and will reach mass production level and adoption within the next five years.