TerraCom Resources Ltd

We initiated coverage of TerraCom Limited (ASX: TER) on 7 March 2022 with a Buy rating and positive outlook for the future. At the time the share price was A$0.42, the company had A$12.4m in Cash and A$202m in estimated debt and our valuation and price target was A$0.87 and A$1.30 respectively. In this report we upgrade our valuation and price target to A$1.87/share.

Since initiation, we have seen TER undergo a metamorphosis, with the company delivering or announcing the following:

- Repayment of Euroclear Bond (Est. A$132m of payments since initiation);

- Conversion of the A$27.3m of OCP debt to equity by issuing 39.9m shares;

- Securing long term Blair Athol off-take agreement of up to 1.25mt of coal over 13 cargoes to August 2023;

- Executed and delivered first cargo on a US$60m (A$86m) coal sales prepayment facility based on a 600,000 tonne coal sales off-take agreement with pricing based on and linked to the API4 index at time of delivery;

- The retirement of Executive Chairman, Craig Ransley;

- The resignation of Non-Executive Director, Matthew Hunter;

- Declared its inaugural dividend of A$0.10/share with an ongoing dividend policy of 60-90% of NPAT to be paid quarterly; and

- FY2022 financial report.

In addition to the excellent operational performance of TER, a number of key factors continue to work in its favour: 1. macroeconomic factors 2. increased production and 3. rising coal and energy prices which have translated into significant cashflow and positive sentiment for the sector.

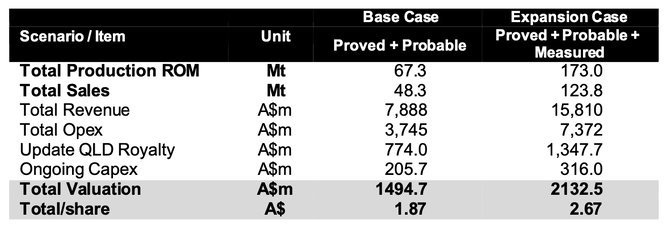

A significant shock to the sector was the update to the Queensland royalty regime which added 3 additional taxation tiers to the coal royalty, being, 20% for prices above A$175/t, 30% for prices above A$225/t, and 40% for prices above A$300/t. On our numbers, this translates to an additional A$774m of royalty being paid by TerraCom through the life of its Blair Athol project.

TER Valuation: With FY2022 results under its belt TER has cemented its position as an established and significant producer. Tailwinds have been favourable for the company with significant increases in forward curves on coal prices, both out of Australia and South Africa, the announcement of a quarterly company dividend policy and the effective extinguishment of its corporate debt position.

A key consideration for investors is the quarterly dividend policy of the company. On our numbers, assuming a 60% NPAT payout ratio, we calculate that TER will pay a dividend of 51¢/share in FY2023 and 21.6¢/share in FY2024. Moving past 2024, we see an ongoing dividend per share of ~21.6¢/share. This represents a remarkable dividend yield for CY2023 of 51%. With the following years being approximately a ~22% dividend yield.

Our price target corresponds to the Base Case valuation of A$1.87/share. Our Expansion Case provides further upside with a valuation of A$2.67/share.