TerraCom Limited (ASX: TER)

It has been just over three months and TER has cemented its position as a significant coal company underpinned by strong production and exports, with operations focused in Australia and South Africa.

Since our initiation report, the company has delivered the following:

- Fully repaid the Euroclear Bond;

- Implemented a 40-70% NPAT dividend policy;

- Fully sold its Blair Athol (BA) coal until October 2022 with BA remaining on track for coal sales in FY 2022 of ~2.3mt;

- In consideration of the outstanding Convertible Bond, issued 39.91m shares for ~A$27.8m consideration; and

- Secured a long term off-take agreement of up to 1.25mt of coal over 13 cargoes from the Blair Athol operation for the period of August 2022 to August 2023.

In addition to the excellent operational performance of TER, a number of key factors have also been in the company’s favour: 1. macroeconomic factors 2. increased production and 3. rising coal and energy prices which have translated into significant cashflow and positive sentiment for the sector.

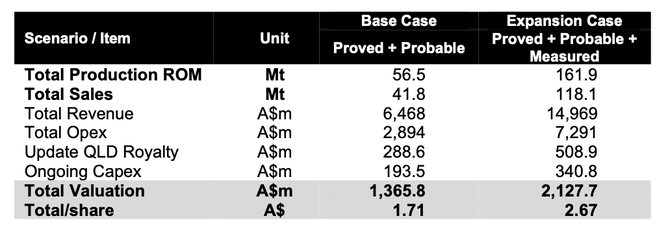

A significant shock to the share price and our valuation was the recent announcement of the update to the Queensland royalty regime which in effect added 3 addition taxation tiers to the coal royalty, being, 20% for prices above A$175/t, 30% for prices above A$225/t, and 40% for prices above A$300/t. The net effect of this change, on our numbers, was an additional A$289m of royalty being paid by TerraCom through the life of its Blair Athol project.TER Valuation: The first half of 2022 calendar year was, and remains, a watershed year for TER with the company becoming an established and significant producer, significant increases in forward curves on coal prices, both out of Australia and South Africa, the announcement of a company dividend policy and the significant reduction in corporate debt and increase in cash position. On our numbers the increase in the Queensland royalty does have a significant impact on revenues and share price, however, this is more than offset by the increase in revenues generated by the company.

Our initiation report had a valuation of A$0.87/share and a price target of A$1.30/share. In line with improved coal prices, reduction in debt and factoring in the new Queensland coal royalty, our revised valuation comes to A$1.71/share representing a 2.9x uplift to the current share price. Considering the weakness of the equity markets, we have applied a 15% discount factor to derive a price target of $1.45/share.