Calima Energy Limited

Since our initiation report, the company has delivered the following:

- Brooks Asset: commencement of the Sunburst 3 Horizontal well drilling program (Gemini 1,2 & 3 Designation) – June 1st

- Due to drilling success the Gemini 4 step out well was spudded on June 27th

- Thorsby Asset: commencement of the 3 Horizontal multistage frac well drilling

- program in the Sparky Formation (Leo 1, 2, 3)

- Completed a 20:1 share consolidation – August 10th

- Issued an updated reserve evaluation– 1st September

- Initiated the process to sell its Montney Assets – 16th September

- Finalised the Thorsby Leo frac program with wells expected to begin production in mid November.

In addition to the excellent operational performance of CE1 and the management team, 2 key factors have acted the in the company’s favour: 1. better than anticipated flow rates leading to increased production and 2. rising oil & gas prices which have translated into a buoyant positive sentiment for the sector.

As a result of CE1’s excellent operational performance we have revised our numbers up from our initiation with production for the May-December 2021 period of 3,297 boe/d average and production in 2022 of 5,440 boe/d average. Further we have revised our hydrocarbon prices up based on the WTI Forward Curve, WCS estimates, Nymex HH forward and AECO Natural Gas price.

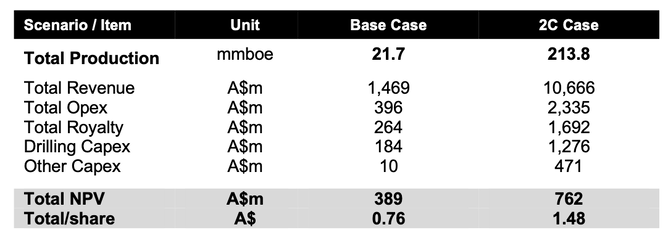

As CE1 have formally put the Montney assets up for sale, we continued to use our risked full field development evaluation (updated with higher gas prices) to assess the potential sale price that CE1 could achieve. We view this as better than a simple per/acre valuation using recent transactions in the area.

CE1 Valuation: 2021 was, and remains, a watershed year for CE1 with the company becoming a producer and bolstering its reserves position.

Our initiation report had a valuation of A$0.30/share (20x $0.015 pre- consolidation) and a price target of A$0.52 (20x A$0.026/share). In line with the improved production profile and higher hydrocarbon prices, our revised valuation and price target comes to A$0.76/share and A$1.48/share respectively, representing a 6.7x uplift to the current share price.