Downstream Refinery: BSX strategy is to build a downstream refinery (Ta Khoa Refinery or TKR) in Vietnam to produce Nickel-Cobalt-Manganese (NCM) precursor for the booming Lithium-ion battery industry. The PFS results released late July considers a 400,000 tpa feed of nickel concentrate. About half of the feed will come from a new 6 mtpa Ban Phuc concentrator and the other half needs to be purchased from third-parties with the assistance of Trafigura, a global metals trader.

New Upstream Concentrator: In October 2020, BSX announced a maiden mineral resource for the Ban Phuc disseminated sulphide deposit: 44 million tonnes indicated @ 0.53% Ni and 14 million tonnes inferred @ 0.35% Ni. At the same time, BSX released the results of a Scoping Study for a 4mtpa (base case) and 6 Mtpa new concentrator. To provide at least half of the TKR feed, we have retained the 6 Mtpa case with a 48 million tonnes mining inventory @ 0.48% Ni, operating for 8 years.

Existing Upstream Concentrator: the existing 450,000 tpa concentrator will focus on treating massive sulphide veins (MSV) as they are discovered and developed. At this time, BSX needs to delineate sufficient mineral resources to justify a restart of the plant.

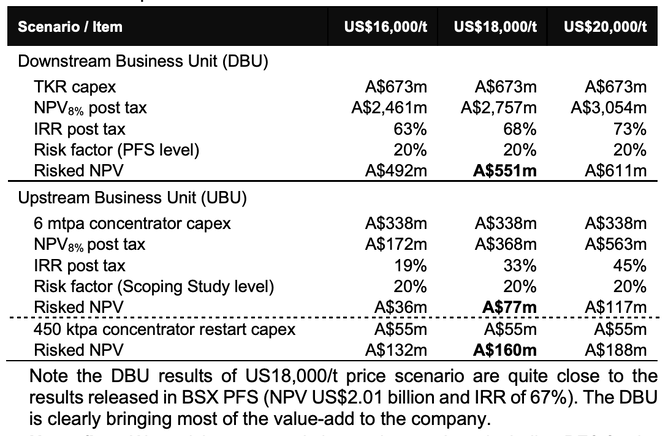

Ta Khoa Business Units Valuation: We have modelled the two business units separately assuming a 100% payability of the Ni-Co-Cu-PGE concentrates produced at Ta Khoa.

News flow: We anticipate several share price catalysts including PFS for the Upstream Business Unit, completion of the Ta Khoa Refinery DFS, Phased construction of a pilot plant in Vietnam to produce NCM811 Precursor (phase 1: 20kg/hour Ni concentrate feed, phase 2: 1,000kg/hour), continued aggressive drilling to increase mineral resources at the Ta Khoa Nickel Project, secure off-take for third-party feed, final investment decision in CY2022.

BSX Valuation: As the company continues to de-risk the various parts of the project and build new mining inventory in the form of DSS and MSV, it continues to add value to shareholders. Our speculative value currently stands at A$805 million or $1.90 per share, including some A$40m of new equity raised at $0.50 per share.