We initiated on Melbana Energy Ltd (ASX: MAY) on 6th June with a Speculative Buy rating and valuation of $0.21/share. At that time MAY was gearing up for its drilling campaign in Cuba targeting the Amistad, Alameda and Marti Reservoir in Block 9.

Since then, Melbana has been running full tilt achieving significant milestones in a short period of time and seeing positive price movement based on stellar drilling results. Since our initiation Melbana has:

1) Bulked up its management team;

2) Prepared, installed and commenced its first appraisal well in Cuba (Alameda-2);

3) Announced the Maiden Prospective Resource of the Hudson prospect;

4) Conducted a production test of the shallowest unit of the upper Amistad interval

and flowed oil to surface.

Most significantly, the drilling campaign in Cuba has revealed a previously unexpected characteristic of the upper Amistad interval. During its production test, Melbana was able to flow oil to surface without external assistance. This translates to self moving hydrocarbons on that level. Where this is important is that, prior to drilling, Melbana assumed a very low chance that this section would flow unassisted and as such did not include the section when calculating and publishing its Prospective Resource of the Amistad Structure and consequently total volumes of Cuba Block 9.

The unexpected productive interval of Amistad has been assessed at 64m TVD and now needs to be reconsidered/analysed by Melbana as it now has a much greater chance to be developed in the future, a nice problem to have.

Drilling has been ahead of schedule, as we mentioned previously, Melbana’s drilling contractor, a subsidiary of Sherritt International, has decades of experience in Cuba drilling and producing hundreds of oil and gas wells over the past 25 years. It seems that Melbana certainly picked the right contractor.

As of 14 July Alameda-2 well was at 1,597 metres measured depth (mMD) with planned total depth of ~1,960 mMD expected by end July. We speculate since drilling has been progressing so well, they may push ahead and drill deeper than planned to gather more data or if they are still encountering hydrocarbon bearing sections.

The successful Alameda-2 well was a direct follow up of the successful Alameda- 1 well. We anticipate that the rest of the Alameda-2 drilling campaign will be successful and are hopeful that the Alameda-3 well, expected to spud following the completion of the Alemada-2 well, will also be a success for the Company.

We have updated our valuation target for Block 9 PSC by increasing the prospective resource of the Amistad interval from 88 mmbbl to 103 mmbbl.

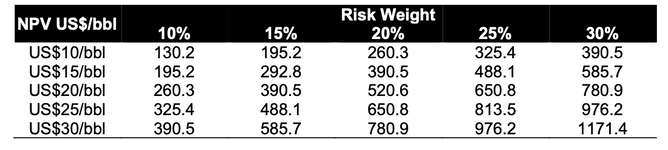

CUBA Block 9 PSC Project Valuation: using various Brent prices & Risk Weights.

News flow: the key catalysts in the short and medium term is the ongoing results from the Alameda-2 appraisal well and subsequent spudding of Alameda-3 followed by results from the drilling.

Update to Valuation: We have updated our valuation to account for 1) Updated cash position, 2) Increased overhead costs, 3) Increased volume estimate of the Amistad structure and 4) Maiden resource estimate for the Hudson prospect.

MAY valuation: Our sum of the parts valuation considers a 25% (or 75% risk discount) of the Cuba PSC 9 NPV estimated using an oil NPV price of US$25/bbl with a valuation of A$650.8 million or $0.19 per share. Factoring the other acreage and volumes held by MAY we assume a 90-95% risk discount and an oil NPV price of US$10/bbl. Our total sum of parts valuation of MAY comes to $758.2 million or $0.23 per share.